It ain't only about the rain

Bitter Harvest – 2

DIONNE BUNSHA

YAVATMAL, MAHARASHTRA:

The monsoon, in Vidarbha at least, has washed away an enduring myth. “The age old notion of farmers jumping with glee when the first monsoon showers fall is now merely a delusion confined to primary school text books. The reality here is quite different,” says Suryapal Chavan from Nandgaon taluka in Amravati.

Extensive damage to the cotton and jowar crop in this region last year due to unseasonal rains, hail storms and a pest attack shattered the local economy, leading to 60 people committing suicide.

“Most farmers here are in a peculiar dilemma. While they want to make up for the previous year’s losses, they are unable to find the money for ploughing, preparing and sowing their fields. The majority have not yet begun work on their lands,” Mr Chavan explains. This dilemma has led to other forms of deprivation which have been overshadowed by the public attention directed towards the dramatic suicides in Vidarbha.

Climatic changes were merely the last straw that exposed the real, deep-rooted problems of the rural economy in this area. These include the shrinking bank credit, heavy dependence on money lenders, unscientific agricultural practices and the vice-like grip that local traders have on the produce market. With the government turning a blind eye to these issues, the coming kharif season does not augur well for farmers here who have no money to invest in their fields.

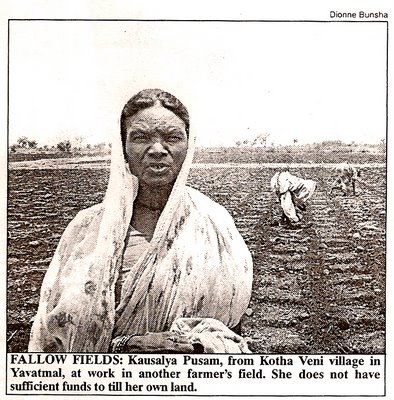

Left with no other choice, several land owners have left their fields fallow. They are working on others’ fields to try and scrape together enough to survive. “The rains have just arrived and I should be working on my land. But that may not be possible this year,” says Kausalya Pusam, a resident of Kotha Veni village in Kalam taluka of Yavatmal.

After slogging it out in the fields, she does not want to be paid in cash. “Seeds would be a better option. At least our land will not lie fallow in the coming season,” says Kausalya, whose family owns five acres.

Chief minister Manohar Joshi visited Kausalya’s village to hand over a cheque of Rs 1 lakh to the family of a suicide victim. “But he left in his helicopter immediately after, without bothering to speak to anyone else,” complains Chabbulal Jaiswal, Kausalya’s employer.

While Kausalya’s family was able to hold on to its land, several others were forced to sell off their agricultural properties to pay off their debts. Gajanan Bhomle from Waiphad village in Wardha sold off his two-acre plot to repay his loans amounting to Rs 80,000 borrowed for crops, constructing a well and to conduct his sister’s wedding.

“Now I look for work in others’ fields. The daily wage rate for agricultural labour has reduced from Rs 50 to Rs 35 for men and from Rs 35 to Rs 20 for women. Employers cannot afford to pay the full wages. You either take it or leave. There are many others looking for work,” says Gajanan.

While marginal and small farmers are in most distress, those with medium to large sized holdings are also finding it difficult this kharif season. Says Vijay Kuldhariya, the sarpanch of Dahegaon village in Wardha, “I have 45 acres of land. But I have prepared only 10 acres for sowing. The banks will not give me money to cultivate the rest as I was unable to repay my previous loans. If I am in such a quandary, can you imagine the plight of the smaller farmers?”

Even those who have managed to sow their fields are using second generation seeds, whose yields are far lower than the hybrid variety. Shops selling farm products are hardly doing any business. “Last year, I sold goods worth Rs 80,000 in the week after the first monsoon shower. But this year, I have not even sold one item,” says Dinesh Kothari who owns a shop in Waiphad village of Wardha.

In a bid to bail out the cultivators from this agricultural crisis, the state government hurriedly announced certain fire-fighting measures. The chief minister promised to provide seeds worth Rs 1,000 to farmers. Interest on bank loans are proposed to be waived so that short term crop loans can be extended to the medium term. This will make defaulting farmers eligible for bank credit this season.

“Of what use are these waivers?” asks Ashok Dhavale from the Maharashtra Kisan Sabha. “Only a few big farmers actually have access to bank credit. The rest rely on moneylenders who charge interest ranging from 60 to 120 per cent.”

Even the few who may benefit from the waivers are impatient. “The banks are waiting for written orders from Mantralaya before issuing new loans. By the time the bureaucracy get moving, the rains will have gone,” says Vijay. Adds Dilip Madhukar Ikhad from Anjangaon Bari village in Amravati, “I will have to go back to moneylenders who may threaten to take our land. They cut our throats with love.”

Until the government starts showing its ‘love’ for farmers, who constitute 61 per cent of the state’s work force, they look forward to little besides the tyranny of debt.

3 July 1998, The Times of India, Mumbai

No comments:

Post a Comment